THE BLACK SEA GRAIN INITIATIVE

How it started and why it

ended

Articlე by Agnieszka Kopertowska-Latoszek

and Vakhtang Maisaia

July 2023

Introduction

Whatever you call it, an unprovoked Russian full-scale invasion on Ukraine or a Special Military Operation in Ukraine, the aftermath is the same. February 24th 2022 was the day when people started being killed in regular military actions, many had to leave their homes both to seek safe shelter abroad or to be deployed to the battlefield. Many buildings, roads, bridges, farmlands, factories, power plants started to be military targets rather than objects that serve the people like they should. Ever after the whole Europe is in great danger, great economic collapse and in a great mess.

Terms of Agreement

All

participants of the Initiative agreed to establish a Joint Coordination Centre

(JCC) in Istanbul, comprised of

representatives of Ukraine, the Russian Federation, Turkey and the United Nations, which role was to

enable the resumption of exports from Ukraine of grain, other foodstuffs, and fertilizer, including ammonia,

through a safe maritime humanitarian corridor

from three key Ukrainian ports, Chornomorsk, Odesa and Yuzhny, in the Black Sea to the rest of the world.

At the same time, according to a separate agreement, The UN will be engaged “to facilitate the unimpeded exports to world markets of Russian food and fertilizer – including the raw materials required to produce fertilizers. This agreement is based on the principle that measures imposed on the Russian Federation do not apply to these products.”1 The intention of this part of the deal was minimizing the impact of western sanctions on the export of Russian food and fertilizers.

The

Agreement was initially signed for 120 days with the option of renewing it.

Key figures

The two fighting this war sides are one of the greatest providers of soft commodities like wheat, corn or sunflower products to the world. Both Ukraine and Russia are breadbaskets for many people in different parts of the world. Moreover both countries are producers of fertilizers and their components.

Regarding world’s wheat exporters, both countries are among the top 15 in 2022 by value.2 The countries from the list below account for 90,4% of globally exported wheat by value, Ukraine and Russia combined covered 14,3%.

1. Australia: US$10.2 billion (15.4% of total wheat

exports)

2. United States: $8.52 billion (12.9%)

3. Canada: $7.9 billion (12%)

4. France: $7.4

billion (11.2%)

5. Russia: $6.8 billion (10.3%)

6. Argentina: $3.1 billion (4.7%)

7. Ukraine: $2.7 billion (4%)

8. Germany: $2.2 billion (3.3%)

9. India: $2.13 billion (3.2%)

10. Romania: $2.1 billion (3.2%)

11. Kazakhstan: $1.9 billion (2.9%)

12. Bulgaria: $1.5 billion (2.2%)

13. Poland: $1.4 billion (2.1%)

14. Lithuania: $1 billion (1.5%)

15. Brazil: $967.3 million (1.5%)

Map 2. Wheat production, 2021

Source:https://ourworldindata.org/grapher/wheat-production?facet=none&country=AUS~USA~CHN~CAN~BRA~ARG~RUS~KAZ~UKR~ DEU~FRA~POL~GBR~TUR~ROU

Source:https://ourworldindata.org/grapher/wheat-production?tab=chart&facet=none&country=AUS~USA~CHN~CAN~BRA~ARG~RUS~ KAZ~UKR~DEU~FRA~POL~GBR~TUR~ROU

The next important commodity is corn, where both Ukraine and Russia are listed among top 15 countries accounting for 93,5%

globally export by value in 2022, and together the countries provided

10,7% of world’s export.3

1. United States: US$19 billion (30.5% of total corn exports)

2. Brazil: $12.3 billion (19.6%)

3. Argentina: $8.6 billion (13.8%)

4. Ukraine: $6 billion (9.6%)

5. France: $2.4 billion (3.8%)

6. Romania: $2 billion (3.2%)

7. Poland: $1.3 billion (2.1%)

8. South Africa: $1.2 billion (1.9%)

9. India: $1.12 billion (1.8%)

10. Paraguay: $1.09 billion (1.7%)Map 3. Corn production, 2021

Source: https://ourworldindata.org/grapher/maize-production?tab=map

Chart 2. Corn production in tonnes, 1961-2021

Source:https://ourworldindata.org/grapher/wheat-production?tab=chart&facet=none&country=AUS~USA~CHN~CAN~BRA~ARG~RUS~ KAZ~UKR~DEU~FRA~POL~GBR~TUR~ROU

Chart 3. Export

volume of sunflowerseed oil worldwide from 2016/17 to 2022/23, by country (in 1,000

metric tons) Source:

https://www.statista.com/statistics/620317/sunflowerseed-oil-export-volume-worldwide-by-country/

Other products listed in The BSGI are fertilizers that are crucial plant growth drivers essential in modern farming. There are various kinds of products: nitrogen-based, potassic-based, phosphatic-based, animal or vegetable fertilizers. According to World’s Top Exports5 the biggest fertilizer exporters in 2022 were:

1. Russia: US$20.7 billion (15.5% of total

exported fertilizers)

2. Canada: $13.7 billion (10.3%)

3. China: $11.4

billion (8.5%)

4. United States: $8.5 billion

(6.4%)

5. Morocco: $7.7 billion (5.8%)

6. Saudi Arabia: $6.8 billion

(5.1%)

The group listed above accounted for 51,6% of globally exported fertilizers in 2022. Ukraine was not listed among 30 top exporters last year.

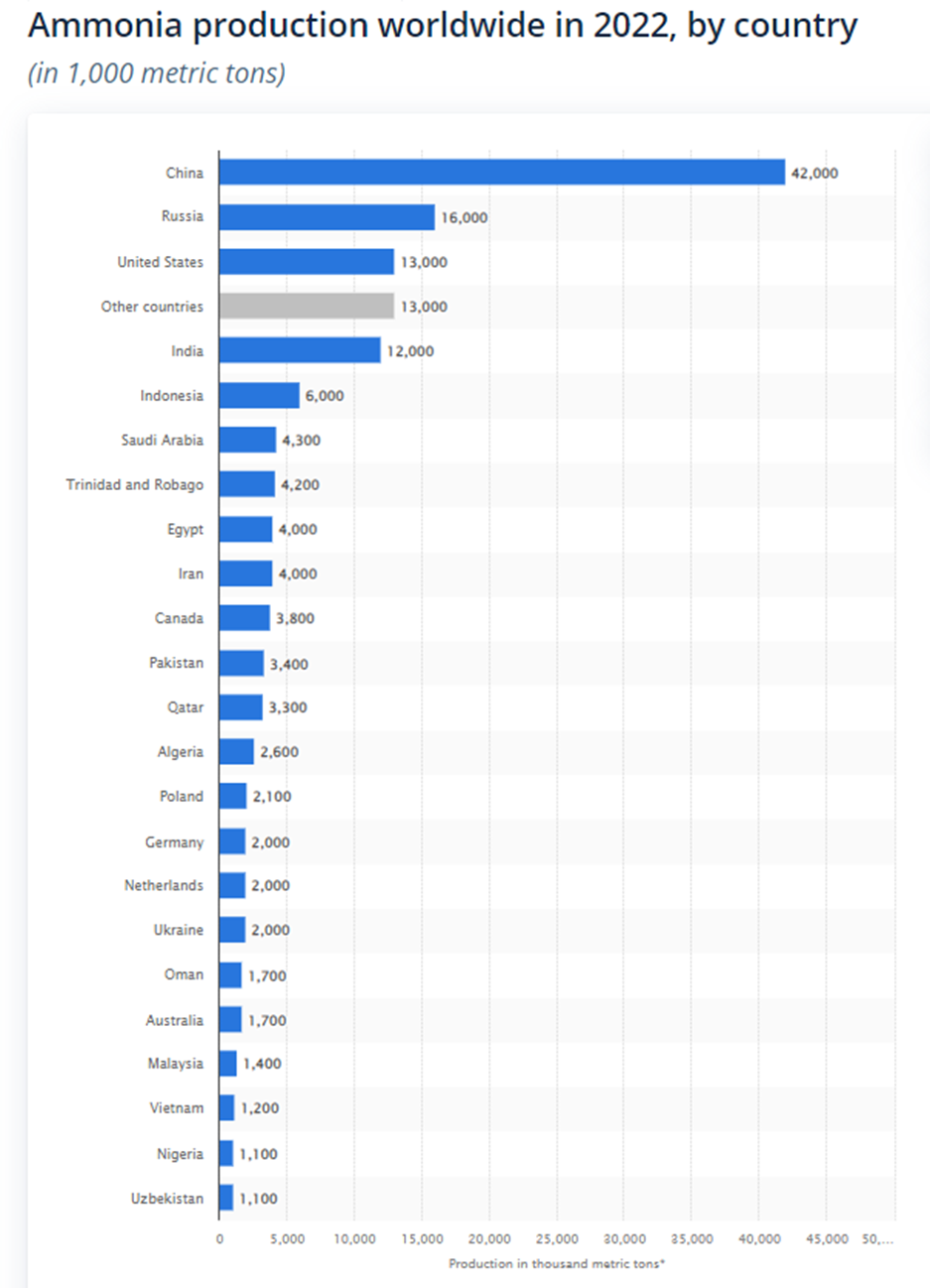

Chart 4. Ammonia

production worldwide in 2022, by country(in 1,000 metric tons)

Source: https://www.statista.com/statistics/1266244/global-ammonia-production-by-country/

The best way to present the market situation in wheat and corn is to show the grain prices in the USA and Europe. Chicago Board of Trade (CBoT) and Euronext Derivatives Paris (EDP) are main price sources and markets to trade. Start of the war caused the prices of Futures to skyrocket.

Chart 5. Wheat Futures CBoT in white,

Milling Wheat Futures

EDP in blue, 5Y chart

Source: Bloomberg

Chart 6. Wheat Futures CBoT in white,

Milling Wheat Futures

EDP in blue, since January

2022

Source: Bloomberg

What happened?

The counterparty that terminated or suspended the Agreement was The Russian Federation. According to the Kremlin for the past 12 months only Ukraine was guaranteed the full possibilities to operate

under the terms agreed but the part concerning Russia has not been implemented. The deal was

one-sided only. Russian officials have been pointing out throughout the last couple of months that Russian demands

are not met, nonetheless they continued

to operate as agreed.

There were several flash points raised by Russian side6:

●

Restrictions on insurance and reinsurance for vessels carrying Russian

grains

were not lifted, which made shipments

of Russian agricultural product much more difficult and pricy.

●

Resumption of supplies of agricultural machinery and

parts did not take place, similarly

●

Resumption of the Togliatti-Odesa ammonia

pipeline.

●

Freezing of assets and the accounts of Russian

companies involved in food and fertilizer

exports were not lifted.

Chart 7. Volume

of agricultural exports

from Ukraine secured

by the Black Sea Grain

Initiative from August

3, 2022 to July 17, 2023, by country(in million

metric tons)

Comments

Post a Comment